Most people, technologically savvy or not, know about a computer tech company called Apple. As you may be informed or not, in this magazine we do not do endless polemics about what-if's and maybe this or maybe that.

We like to tell how it is. We don't copy talking points, research yearly books or follow inventory. Instead we distill information from stock quotes, commodity prices or market-dynamical indices. Moreover we pride ourselves that we are amongst the very best in doing so, and we can extract quite a lot more from a chart then a layman or your run-of-the-mill bank strategist or financial analyst worker bee. We see where we have been and we see where we are going as long as it is mathematically possible to do so. And for our following statement we are adamant that there is a deeper undercurrent of truth dissipating through it and we will give a few company-specific examples as to how and why such a thing is not only possible or probable but inevitable.

Apple computers is dead.

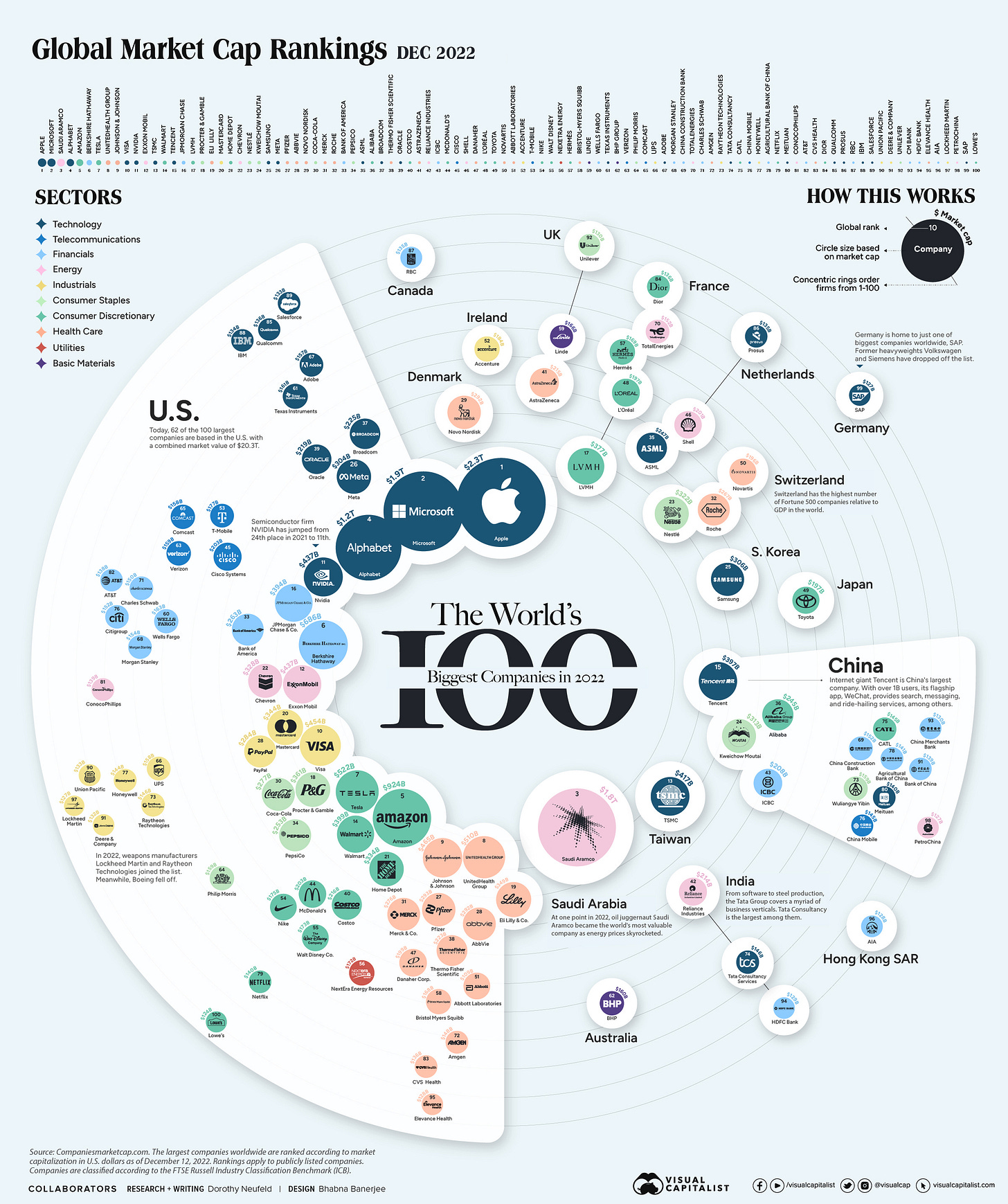

This is the biggest company in the world. How can it be dead? Well, no they are not going bankrupt any time soon. But the importance of the company is fading, the earnings beats are fading and the previous growth numbers will never be seen again.

Who says so?

The market says so. The market has perfect information. Of course, Apple stock may be near all time highs right now. This does not mean that every oscillation of it's stock over the past 20 years did not preview what is to come now in the following years. It did, in fact, do so. Already in the 2010’s Apple's meteoric growth was destined to stunt right about 2023. There is an ultralong term pattern for Apple (exclusive for ALPHA GRADE members) that sees the end of the Apple era right about… now.

Steve Jobs

Steve Jobs, quite the visionary, led Apple out of a rut into consumers' hearts with several iterations of Mac, iMac, iPod and iPhone. He oversaw the software and services walled garden instituted by iTunes, iOS, and the Apple app store. So far so good. Then he died of pancreatic cancer. (spoiler: his medical team was paid very well, and they provided him with good capitalistic service. He did die, however.)

Anyhow, anyhoo, Tim Cook, a decent business man, took over at the helm of Apple. He made a bigger iPhone called an iPad. He made a smaller iPhone called an Apple Watch. He iterated and then he iterated some more. He put his greasy palms on every niche he could find. Beats by DRE was acquired and then Apple made headphones and airpods. You can pay with some hyperlink to your bank account called Apple Pay. Most recently you can even store your cash at Apple for yield. This is commerce. This is not innovation. The era of Steve Jobs his iterations is over. Every incremental update to an iPhone became even more and more incremental to the point of only being cosmetic changes. This cannot hold for a tech company.

AR/VR for the loss

Just like Facebook-parent Meta Platforms poured over 10 billion dollars in a stomach-turning experience called Virtual Reality that has about 30 users worldwide, Apple wil soon unveil a $ 3500 welders' helmet that you have to carry on your face so you have a stereoscopic double iPhone glued to your eyes. Don't get me wrong, I'm sure the execution of the device will be top-notch. Except previously Apple improved on existing markets. There were already markets for computing, for portable phones, for digital watches, for headphones and for credit cards. There is no worldwide market for VR. VR may likely never overtake actual reality. Oh, the humanity.

So,

while Apple bets on a losing horse with VR instead of on a winning horse, like R&D for a non-iterative ultimate iPhone,

while Apple is being greedy with drip-feeding iPhone improvements for guarding next years' margins,

they have created a commercial company, not a tech innovation company

they have created a company culture that is ultimately no longer able to envision the next big thing.

With Tim Cook at the head.

Steve Jobs is dead.